Apple stock has become a big part of the US economy, and investors are hoping for more growth from its services business and wearables. But it can be a challenge to predict how Apple’s share price will perform over the long term.

Before you buy Apple stock, make sure it makes sense in your portfolio. It’s best to buy a diverse mix of stocks, and it’s important to know how much you can afford to invest before making a decision.

Also Read: Australia ndis gets app with blockchain

How Much Can You Afford to Invest?

Apple stock is a great choice for anyone looking to invest in the technology industry. This is because the company’s products are widely recognizable and consumers worldwide love its gadgets. It also has a proven track record of success, being the first U.S. company to reach a trillion-dollar valuation in 2018.

Investors should take time to carefully evaluate whether or not Apple’s financials and performance are right for them before purchasing shares. The best way to do this is by reading the company’s annual and quarterly reports. These documents will provide you with a lot of information about the company’s financial status, including how well it is positioned in its industry.

Another key part of evaluating a company like Apple is by looking at its competitive landscape. If there is a competitor vying for the same market share as Apple, that could negatively impact its bottom line. This is why it’s important to look at competitors, both large and small, when deciding to invest in Apple.

If you’re investing in a mutual fund or ETF, it’s also a good idea to check out the other companies in the portfolio. This can help you diversify your investment and avoid the risk of losing a large portion of your money if one company’s stocks perform poorly.

When you’re investing in individual stocks, it’s important to commit to holding them for a period of at least three to five years. This will give you enough time to ride out the stock’s ups and downs.

The amount of time you plan to keep a stock in your portfolio will also affect how much you can afford to invest in it. Generally, you should only buy between 3 and 5 percent of the total amount of your portfolio. This is especially true if you’re investing in individual stocks, as they can be more volatile than larger-cap investments.

Once you’ve decided to invest in a particular stock, you will need to open a brokerage account and fund it with the necessary amount of money. Fortunately, online brokers make it easy to do this. Some even offer fractional shares, which allow you to invest in a smaller portion of the stock.

What Is Apple’s Biggest Competitor?

Apple is a tech giant that offers consumer electronics, computer software, and online services. Their products are known for their sleek designs, creative marketing, and technical innovations.

However, they do have some rivals in the industry who are willing to challenge their position. These include Samsung, Google, Amazon, and other companies in the technology sector.

If you are looking to invest in Apple stock, it’s important to understand what their biggest competitors are. This will help you make informed decisions when it comes time to buy or sell shares.

One of the best ways to identify potential competitors is to research their financial history and see how they have performed over the years. It’s also a good idea to look at their CEO rankings, product quality score, and employee Net Promoter Score.

Another company that is an Apple competitor is Google, which owns the Android operating system and their own version of iTunes. They are also in the business of online payment services, which could cause some trouble for Apple in the future.

Amazon is another big rival that Apple must consider, as they have been gaining significant market share lately. This is especially true in the e-commerce sector, where they have started selling smartphones and other devices like Kindles.

This is a huge threat to Apple because they are already making money from the online shopping market, and this could quickly expand into other areas. It’s also possible that they will develop their own smartphone and enter the mobile applications market, putting further pressure on Apple.

The other major competitor that Apple must keep an eye on is Dell, which is an American multinational computer company that deals in manufacturing and selling of computers. While Dell is not a competitor for Apple in the smartphones category, they are a primary competitor in the laptops segment where they have several laptops that compete with Macbook.

Lastly, there is Sony, which is a Japanese origin company that specializes in the manufacture of electronics. The company offers products in the areas of consumer electronics, television shows, music, video games, and semiconductors.

How Do You Know When It’s Time to Buy?

There are a lot of different factors to consider when it comes to investing in stocks, so it’s important to make sure you know exactly what you’re getting yourself into. For example, Apple stock is considered a high-risk investment, so it’s best to choose a broker that offers plenty of tools to help you manage your risk.

Before you buy your first stock, it’s important to think about your long-term financial goals. Whether you’re trying to save for a child’s college education or you want to build up your retirement savings, investing in a tax-advantaged account such as an IRA can be a good way to ensure your money will grow over the long term.

Once you’ve figured out what your investment goals are, you’ll need to decide how much you can afford to invest. This is also an important time to consider dollar-cost averaging, a strategy of buying small amounts of stock regularly over time to lower your total costs.

To buy Apple stock, you’ll need to open an online brokerage account. These accounts are similar to a checking or savings account, but instead of being deposited into a regular deposit account, they allow you to trade stocks with ease.

You’ll then need to enter the ticker symbol of the stock you’re interested in, the number of shares (or dollar value) you’d like to buy and select a purchase order type. Common options include market orders, which automatically execute the stock at the best price available in the market, and limit orders, which specify a specific price you’d like to buy the stock for or below.

After you’ve chosen the right order type, you’ll need to enter your payment information and click “Buy.” Once your order is approved, you’ll receive a confirmation email. You can then check the status of your transaction online or on mobile apps to see the exact date and time your order was completed.

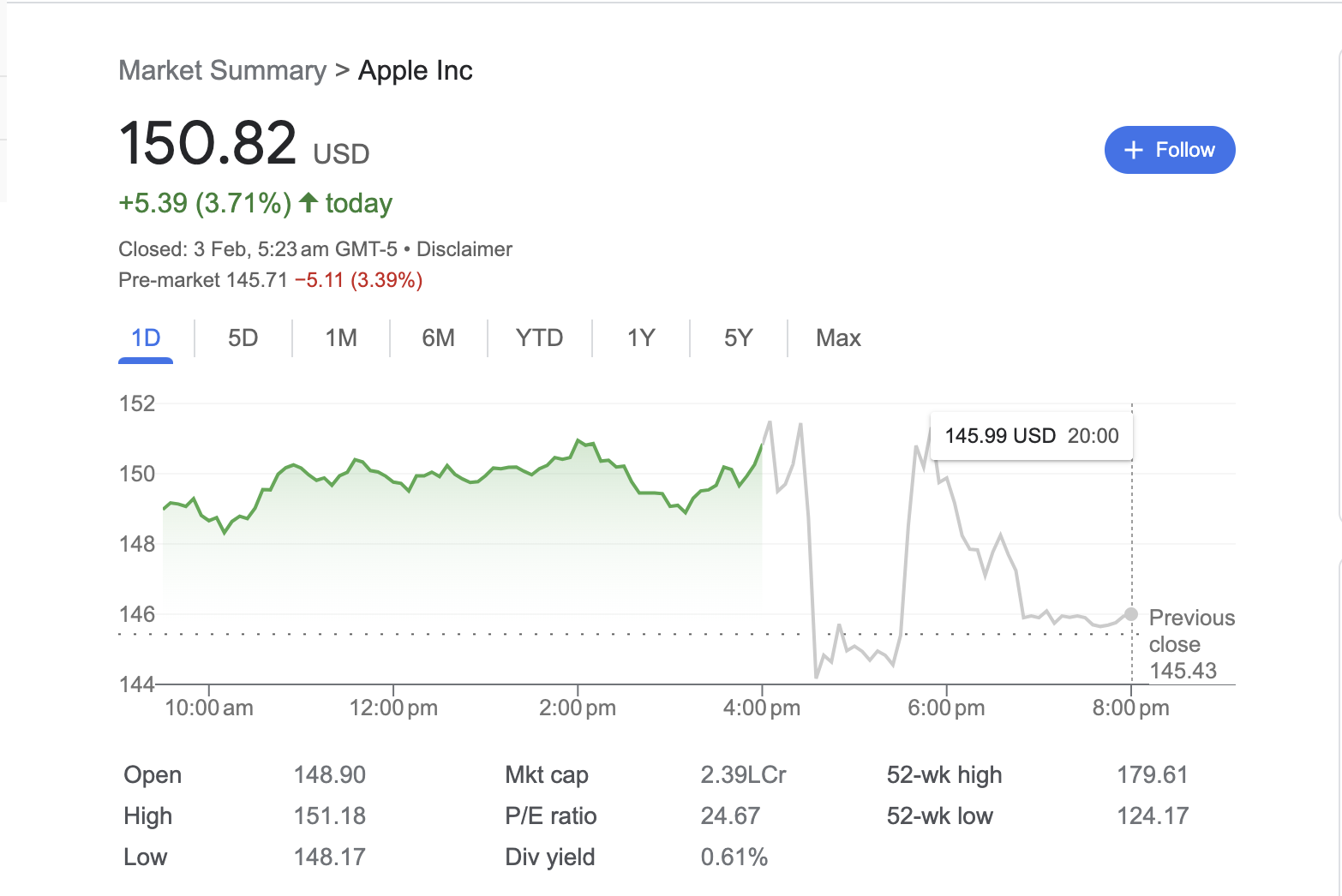

Once you’ve successfully purchased your Apple stock, you’ll want to monitor its performance over time. This can be done with a stock tracking app, which will track your shares and alert you to any significant changes in the price or volume of the stock.

What Is Apple’s Future Prospects?

The future of Apple is likely to be bright thanks to a number of growth opportunities, including augmented reality and virtual reality headsets. It’s also expanding its services business, which is expected to account for a fifth of its revenue in 2022.

HomePod is an important example of Apple’s move to put its AI and machine learning technology into the home. It’s a smart speaker with Siri that can also play music and stream movies and shows.

It’s also working on a smart car that will help people commute more safely and efficiently. That could help the company generate more revenue, especially if it can launch it before the start of the 2020 car tax rebate program.

Apple’s AR and VR headsets are also set to become major players in the industry, with a new version rumored to be coming out this year. It will likely feature a dedicated high-end display, a built-in processor, and an operating system that Apple calls “rOS.”

In the past 2 years, the tech giant has invested in several digital media companies. Its acquisitions include Scout FM, Vilnyx, and Primephonic.

Those acquisitions helped to boost its music capabilities and also lay the foundation for Apple News+, which launched in 2019.

It has also partnered with leading manufacturers of glass equipment and materials, such as Corning. It began investing in these companies as part of its Advanced Manufacturing Fund in 2017.

That investment has helped the company create Ceramic Shield, which is tougher than smartphone glass. It’s also made investments in II-VI, which manufactures laser technology for its Face ID system.

As a result, the company is expected to see a significant increase in iPhone sales in 2022. It’s expected to produce 259 million iPhones in 2022, up 9% from last year.

If Apple can grow these five businesses at scale, the stock is likely to continue to rise in the future. Ultimately, it’s all about how the company monetizes its ecosystem and extends its platform. That’s where Apple’s most lucrative investments are likely to be, according to Daryanani.